If you have an experience of sending money abroad through a bank, you may have heard of the term "SWIFT."

SWIFT is a system used with international money transfers through banks, but not many people know how it actually functions.

This article will explain in detail how SWIFT is used for international money transfers and the points to note when using it.

We will also look at the differences from online international money transfer services, as well as recommended money transfer methods depending on the amount. We hope this will help you find the money transfer method that best suits the situation.

If you have plans to send money abroad, take this opportunity to learn the correct knowledge and prepare for a secure and cost-effective procedure!

The System of SWIFT Money Transfer

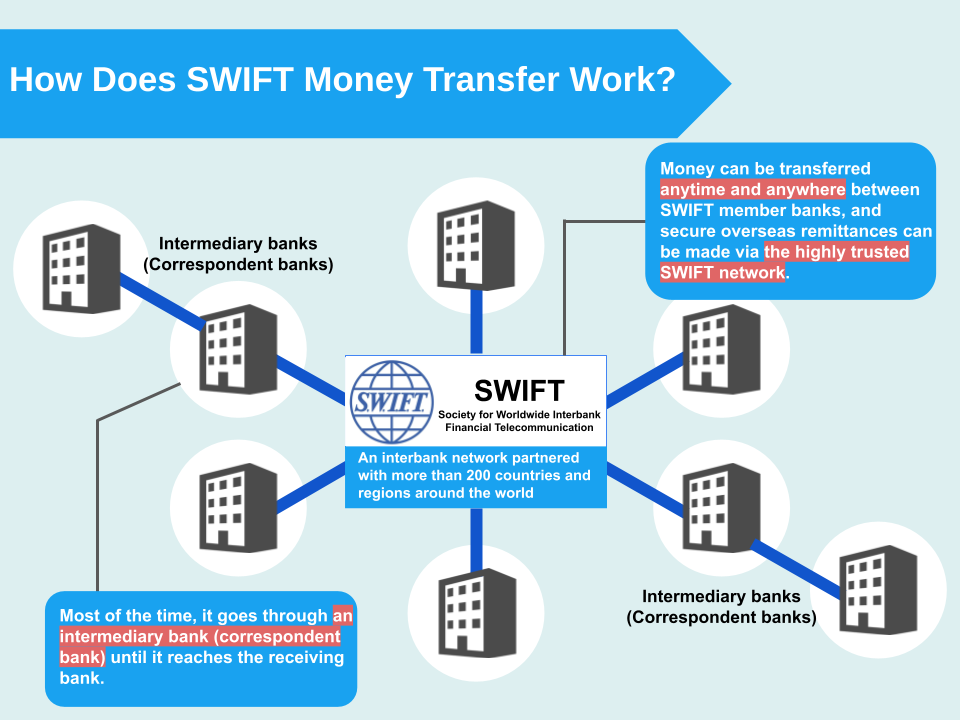

SWIFT (Society for Worldwide Interbank Financial Telecommunication) is an interbank network of which banks worldwide are members. The network operates as a platform for international money transfers.

Partnered with more than 200 countries and regions around the world, SWIFT was originally established in 1973 as a cooperative network to facilitate smooth remittance procedures between banks for foreign currency transactions, such as trades between countries.

Member banks send and receive information such as bank account numbers and names as electronic messages to each other in order to facilitate international money transfers. As long as the originating and receiving banks are both members, it can offer users a secure international money transfer at any time.

With SWIFT, the remittance does not go directly between the originating bank and the receiving bank but goes through multiple banks before reaching the destination. These banks are called intermediary banks or correspondent banks.

The relay bank and receiving bank receive an electronic message from the originating bank, and the procedures are carried out according to the payment instructions in the order of the originating bank, relay bank(s), and the receiving bank.

The number of relay banks changes depending on the case. The more relay banks the transaction involves, the more time and fees are required, possibly resulting in a longer processing time or higher fees.

Points to Note about International Money Transfers Using SWIFT

International money transfers through banks are required to use the SWIFT network. For this reason, SWIFT is practically the exclusive channel for bank remittances.

When using SWIFT for money transfers, there are a few points to keep in mind.

In this section, we will introduce some of the points users should be aware of.

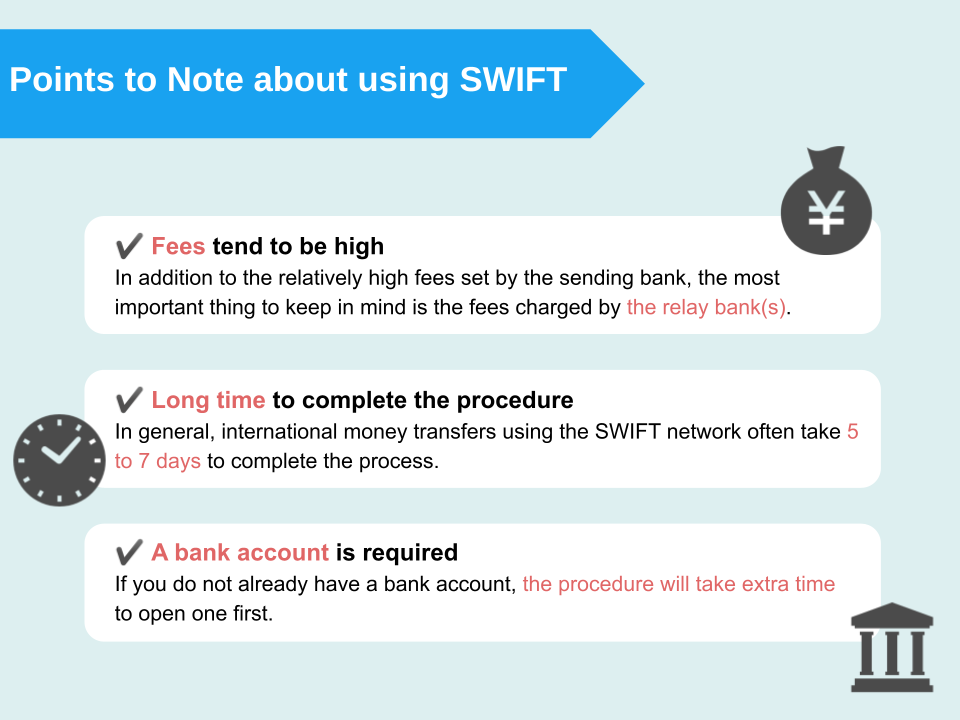

Point 1: Fees tend to be high

In many cases, the fees incurred for international money transfers are higher when using SWIFT.

In addition to the relatively high fees set by the sending bank, the most important thing to keep in mind is the fees charged by the relay bank(s).

In a bank transfer, the procedure does not proceed directly to the receiving bank, but rather through a number of banks before reaching the receiving bank. These relay banks are also members of SWIFT, and the more banks that are involved in the transaction, the more fees will be incurred.

Since the route for international money transfers via SWIFT is determined after the procedure is completed, the number of relay banks cannot be known in advance. This may result in higher fees than expected, so be sure to take it into consideration when setting the budget.

Point 2: Long time to complete the procedure

International money transfers via SWIFT require a certain period of time to complete the transaction.

Because the transactions are conducted with relay banks and receiving banks across national borders, money cannot be transferred as quickly as domestic bank transfers.

In general, international money transfers using the SWIFT network often take 5 to 7 days to complete the process.

Although money transfers using SWIFT are reliable and secure, there is a disadvantage in that they cannot be processed quickly if an urgent money transfer is required.

Point 3: A bank account is required

To send money abroad using SWIFT, users need to have an account at the originating bank where the money transfer is processed.

Bank transfers use the money that is already in the account. If you do not already have a bank account, the procedure will take extra time to open one first.

In addition to opening an account, users must also submit identification documents specified by each financial institution when sending money internationally. We advise checking the official website of each service in advance for specific required documents and the flow of procedures.

Why are Fees Higher for SWIFT Transfers?

One of the main reasons for the high fees incurred with SWIFT transfers is that it involves relay banks, also known as correspondent banks.

In this section, we will take a further look at relay banks, which is essential to bank transfers, and the fees.

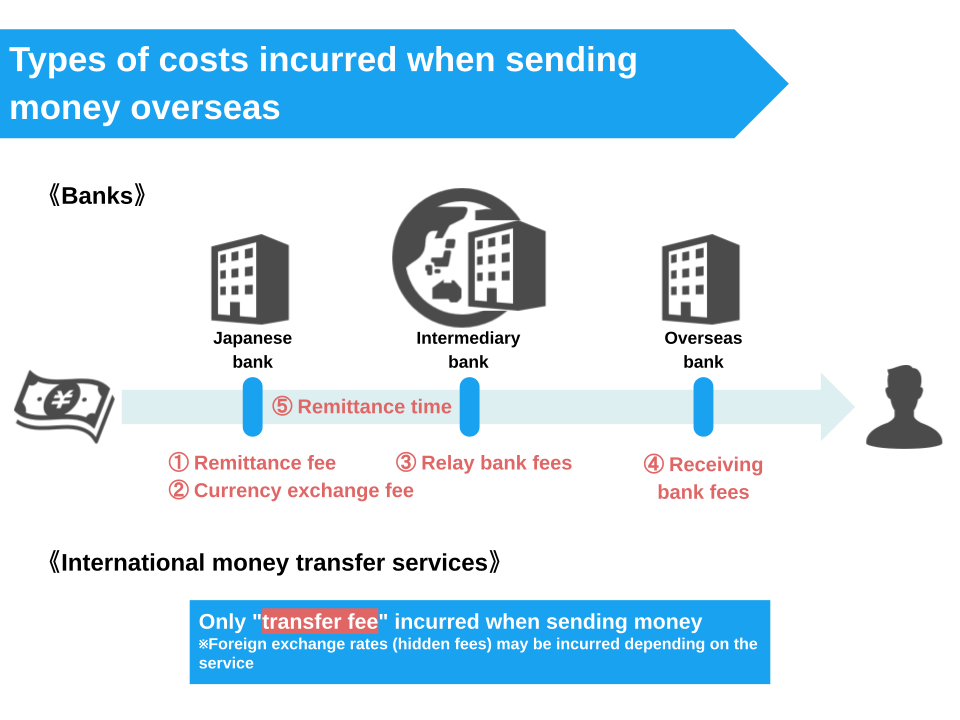

Types of Fees Incurred for SWIFT Transfers

SWIFT has more types of fees compared to other online international money transfer services. The following table shows examples of fees incurred for SWIFT money transfers.

Receiving fees and relay bank fees, in particular, are fees that are unique to bank transfers.

Since these two fees are incurred on the SWIFT network, they do not apply to remittances through international money transfer services, which do not use the network.

While SWIFT makes international money transfers more secure and reliable, it is important to understand in advance that more fees will be charged with it.

Fees Charged by Relay Banks (Correspondent Banks)

A relay bank (correspondent bank) is a bank that acts as an intermediary between the originating bank and the receiving bank when making an international money transfer. Relay banks are contracted on the SWIFT network, and only go through it for international money transfers using SWIFT.

Of course, a fee is charged when a transfer goes through a relay bank. Each relay bank's fee is charged to the user through the bank from which the money is sent.

In addition, the number of relay banks is not limited to one, and in some cases, money is sent through multiple financial institutions. The more relay banks there are, the more fees are charged. As a result, fees with bank transfers are often higher.

The number of relay banks involved in the transaction are determined by the originating bank, not the sender.

The remittance route also varies depending on the time of year and location. When making a bank transfer, it is necessary to take the relay bank fees into consideration before deciding on the amount of transfer.

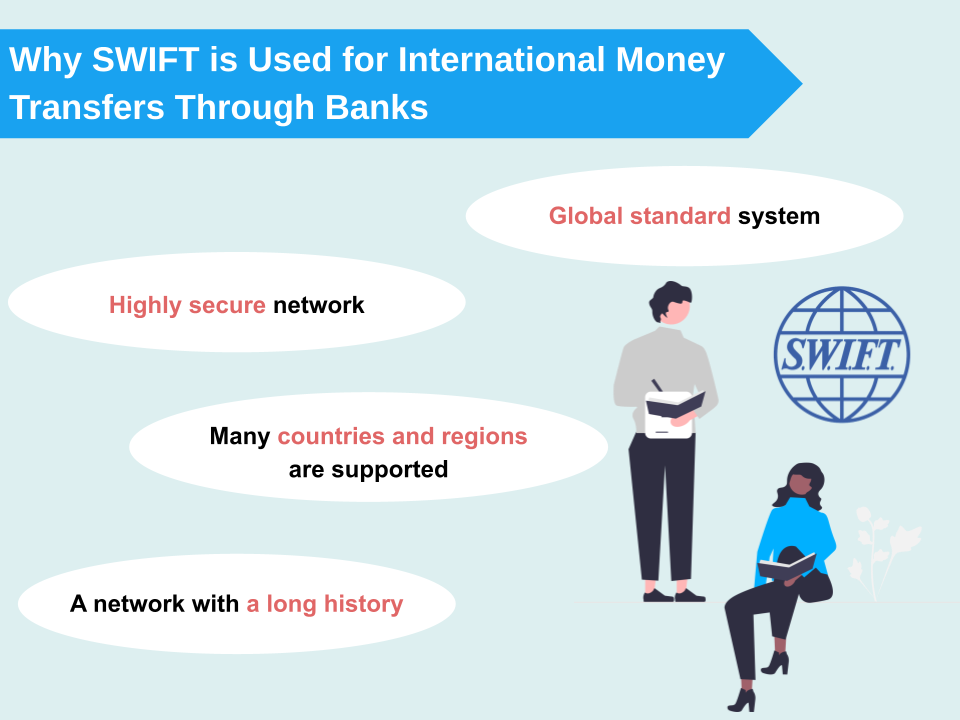

Why SWIFT is Used for International Money Transfers Through Banks

So, why do banks use the SWIFT network for international money transfers despite high fees?

The following are some of the reasons.

- It is a global standard system

- It is a highly secure network

- Many countries and regions are supported

- It is a network with a long history.

First of all, SWIFT is adopted as the global standard network system. Since currency transactions are conducted between countries, it is very important to use a global standard network in order to facilitate smooth transactions.

Another reason why SWIFT is chosen is that it is a network using banks as credit institutions, which ensures security.

Money transfers between organizations and countries tend to involve huge sums of money. Therefore, it is important that the transaction is conducted through a network with guaranteed security.

SWIFT transactions use electronic messaging, assuring high security because they are traceable in the event of a problem, as they keep a history.

Due to this high security and global standard, banks in more than 200 countries are members of SWIFT.

The more member banks there are, the more countries they can support transaction to, which means that banks can easily use SWIFT for international money transfers in many countries.

Furthermore, SWIFT is a network with a history of over 40 years. The extremely high level of security and reliability is a great advantage, but the fact that the old-fashioned system is still in place means that fees are high, which can also be an issue.

International Money Transfers Other Than SWIFT

In addition to money transfers via SWIFT, there are online international money transfer services that use online electronic payments.

Online international money transfer services are highly convenient as they allow transfers to be made through an online-based procedure. Since there are no relay bank fees or receiving fees, the fees can be kept low.

Online money transfers mainly use two types of methods:

P2P Money Transfer

A remittance method in which transactions are made directly between peers (peer to peer) or between individuals (person to person). There is no intermediary, which allows users to send money directly to the recipient on the app.

Online Money Transfer

A method that uses a service to send money overseas via the Internet. The amount of money to be transferred to a designated recipient is specified, and the necessary fees are paid to the service provider. All procedures can be completed online.

Online international money transfer services are highly convenient as they allow users to complete the payment with a smartphone. Due to this convenience, the number of users has been increasing rapidly in recent years. In addition, some services have been approved by government agencies, providing users with a highly secure money transfer service.

Is it Possible to Send Money Internationally without a Bank Account?

While international money transfers via banks require a bank account, online international money transfer services allow users to send money internationally without having a bank account.

Some online international money transfer services allow you to link your debit or credit card to the service, making it possible to send money via credit card payment.

In general, bank transfers require users to have an account and to have completed the identification verification procedures. With online international money transfer services, a debit card is usually enough to complete the transaction.

If you have an urgent need of sending money abroad, an international money transfer service would be very convenient because it saves the trouble of having to go through the procedures.

Comparison of SWIFT and Online International Money Transfer Services

So, which service is more recommended for international money transfers?

In this section, we will compare the two types of services, SWIFT and online international money transfer, in terms of cost, speed, and security.

Cost, Speed, and Security

In terms of cost, online international money transfer services have lower fees and are more economical. SWIFT money transfers inevitably incur many types of fees, and furthermore, the fees are set high, so they are not the most recommended method if your priority is to keep the cost low.

Also for speed, online international money transfer services are quick, while SWIFT transfers take 5 to 7 days to complete as they go through relay banks.

On the other hand, in many cases, online services complete the procedure within the same day or two business days, making it possible to complete the procedure smoothly even upon urgent needs.

Then, what about security?

When it comes to security, SWIFT, which is operated as a global standard network, has the advantage.

SWIFT is a globally recognized money transfer platform operated by banks, so it has a high level of social credibility and is highly safe from the perspective of protecting personal information.

Nevertheless, there are also some online services that are government-approved and highly secure.

In the past, when online international money transfer services did not exist, the only way to send money was through the SWIFT network.

Many countries and large companies still use SWIFT transfers today as a result of this, but it is also due to the large transaction amount, often being around a hundred million yen at a time.

Now that online international money transfer services have spread thanks to the development of information technology, international transfers via online services are also very safe and secure for individuals or small and medium-sized companies.

SWIFT Transfers are More Suitable for High-Value Transactions

Since SWIFT transfers were originally created as a remittance network for use between banks in different countries, they are more suited to high value transactions exceeding tens of millions of yen than small value transactions of a few thousand yen to several million yen between individuals.

The detailed screening and procedures with SWIFT transfers are designed to be time-consuming and costly because of the transaction value of tens or hundreds of millions of dollars.

Therefore, for users who only need to send money between individuals for living expenses, etc, online money transfer services are more suitable. Not only are they more convenient than bank transfers, but they also have a good security, offering users a smooth and safe procedure.

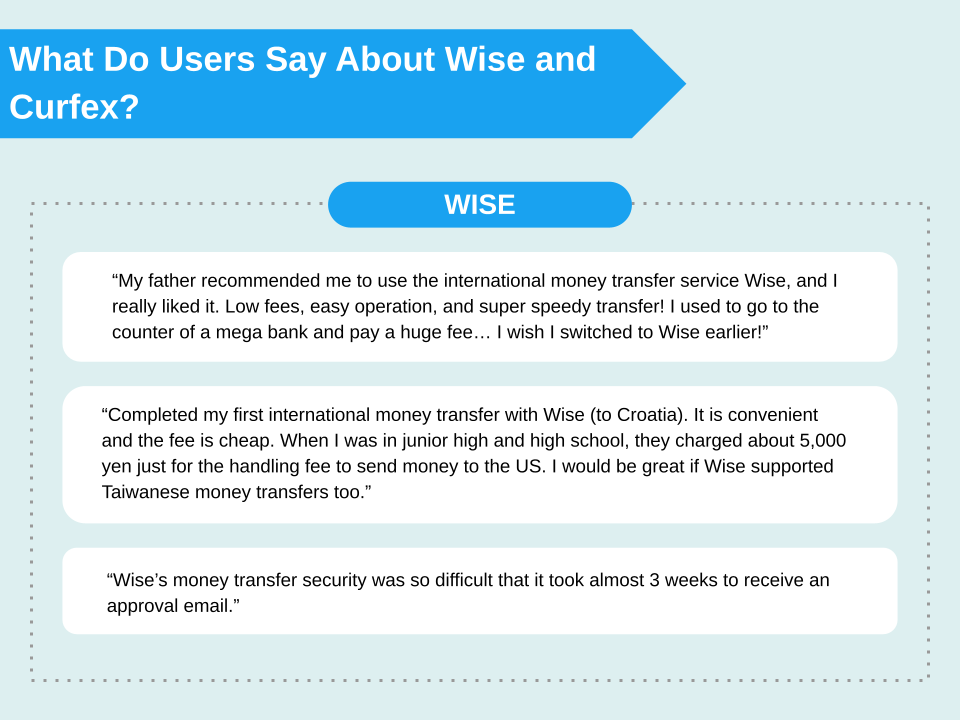

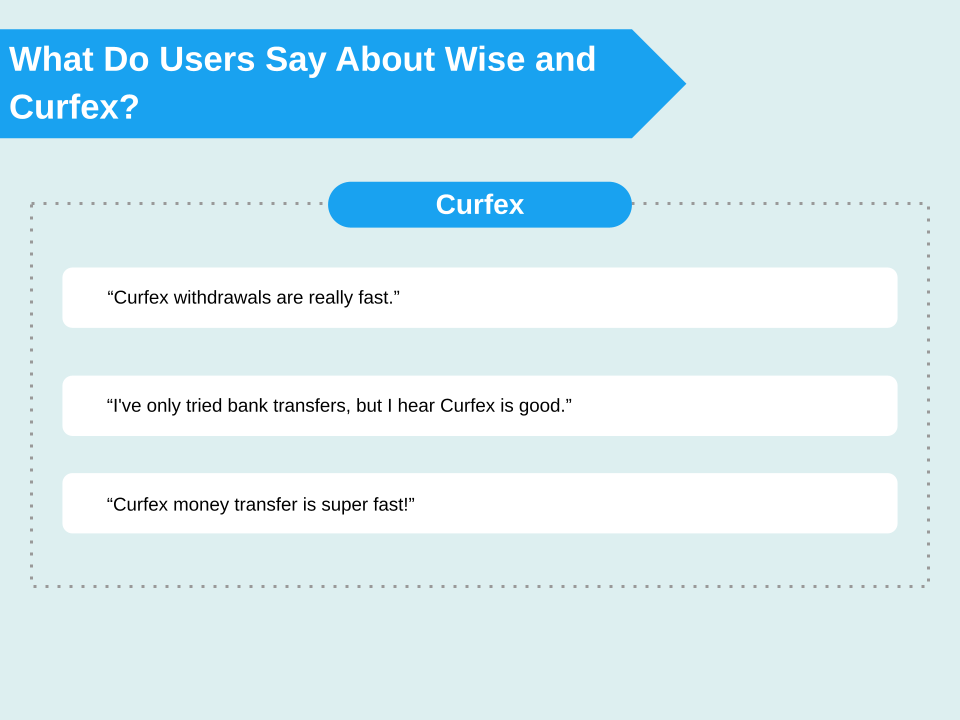

Curfex is Recommended for Individual Transactions

If you are looking for an international money transfer service with both cost-effectiveness and security, we highly recommend using Curfex.

Curfex is an online international money transfer service with over 6 billion yen in transactions each month, supporting transactions to 48 countries worldwide.

One of its major features is its low fees. While general financial institutions often set their own exchange rates by adding a commission to the market exchange rate, Curfex uses the mid-market rate, which is the market rate as it is. Users do not have to worry about paying more fees than necessary.

Furthermore, it currently offers a fee waiver campaign for the first transfer, which is highly advantageous for those who want to keep costs down.

Curfex is also a highly secure money transfer service that is certified as a money transfer agent by the Japanese government and approved by the Financial Services Agency (FSA).

Even in the unlikely event of a default on the side of Curfex, users can rest assured that their money will be returned because the deposit is held with the FSA.

The following is an overview of Curfex's cost aspects and the number of days required for money transfer.

Comparison of SWIFT and Online International Money Transfer Service

In this section, we will demonstrate the difference in fees between SWIFT and Curfex, an online money transfer service.

We will look at the difference in the amount of money received when sending the same amount of money to the U.S. using SMBC and Curfex.

*SMBC fees are calculated based on e-Trade fees. Lifting charges or currency exchange fees for yen may be incurred separately.

Curfex has a limit of 1 million yen per transfer, so amounts exceeding that limit must be sent in multiple transfers. For users who need to send more than 1 million yen at a time, banks may be able to complete the procedure more smoothly.

On the other hand, if the remittance is less than 1 million yen, the recipient can receive a higher amount and save fees with Curfex. Although it will be a hassle, you will save more from transferring with curfex. So for budget or cheaper option can go with curfex. If those who need smoother procedures can go with SMBC.

Although it may not seem like a large amount by itself, fees can add up to a large payment in the end.

If the transfer is less than 1 million yen at a time, we confidently recommend using Curfex for international money transfers.

Use Curfex for Smooth Money Transfers at a Low Fee!

While bank transfers using the SWIFT network are highly reliable, there are also disadvantages such as high fees and slow speed that comes with its old-fashioned transfer method.

Online international money transfer services, in contrast, have been increasing rapidly in popularity in recent years. In particular, Curfex is a highly secure online service that has been approved by the Financial Services Agency with its major feature of low transfer fees.

It also offers a fee waiver campaign for the first time transfer, allowing users to greatly reduce costs.

If you are planning to send money internationally for personal use, or if you are considering sending up to 1 million yen at a time, we highly recommend using Curfex.

Click here to sign up